Umbrella payroll calculator

So you will never be left with an unanswered question. In the case I will need any umbrella company I will.

Limited Vs Umbrella Company Tax Calculator It Contracting

Check the I enjoy the 30 ruling and find the maximum amount of tax you can save with the 30 percent ruling.

. There are steps you can take to appraise your premiums including using this simple SUI calculator to determine potential savings. Weve answered your questions here. Refer a friend.

State Unemployment Insurance Calculator. NWMs umbrella solution replaces the burden and inconsistency that comes with managing your contract payments with a regular income you can depend on. Youre not alone when you go limited.

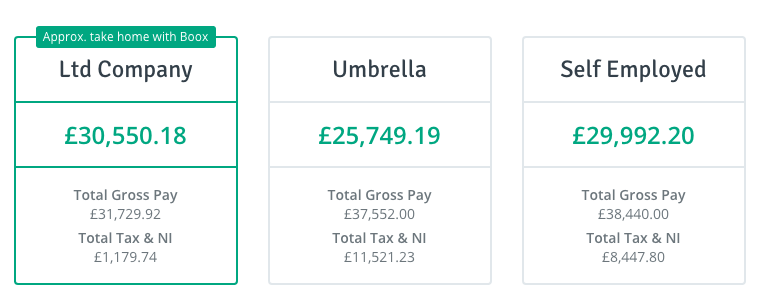

Well match you to the right service. Umbrella Compliance Customer Service. Our free online tax calculator is all you need to compare your pay under a PAYE Umbrella Company Director Umbrella Company or Personal Limited Company.

Its worth bearing in mind that all umbrella companies have to abide by the same HMRC rules regarding tax so regardless of what their umbrella take home pay calculator says the only difference in take home pay is down to the margin they retain. A leading umbrella payroll company built around you. Agencies use this type of payroll management to help contractors get paid compliantly.

43-4161 Human Resources Assistants Except Payroll and Timekeeping. An FCSA Accredited umbrella company and specialist accountants for limited company contractors and self-employed CIS workers call us free on 0808 196 9601 With a focus on service and compliance we get you paid on time every time call us free on 0808 196 9601 JOIN US Calculate your take home pay Our calculator will provide an illustration of what your. Our hands-on team will guide you.

The umbrella calculator is based on several assumptions. Being accredited by the FCSA means we operate compliantly to the highest industry standards giving an extra level of comfort and security to both our Umbrella workers and the agencies we work with. A contractor who is inside IR35 and paid via an Umbrella Company.

Enjoy the benefits of setting up a limited company with our sister company 2020 Accountancy. An established umbrella payroll company with you at the heart of our business. Quickly Calculate your take home pay using our umbrella solution.

43-4171 Receptionists and Information Clerks. Get the latest financial news headlines and analysis from CBS MoneyWatch. Online Tax Calculator 2022 to see how much could earn Contracting.

Whether youre new to contracting or are looking to switch from another umbrella solution youll enjoy unbeatable support provided by our team when you join Parasol. We make your work and pay our priority so you can focus on what matters to you. It is low cost compliant with all relevant legislation attracts a heap of benefits and is possibly the easiest way to get paid for temporary assignments.

VIEW DETAILED CALCULATOR The. Join Now Switch Now. Find out how much you could be saving.

Use our PAYE umbrella calculator above to quickly find out based on your hourly or daily rate. What you need to do. Bishopsgate Employment Services provides umbrella PAYE and subcontractor CIS payroll solutions to organisations within the UK with compliance and customer service at the heart of what we do.

43-4160 Human Resources Assistants Except Payroll and Timekeeping. If you begin claiming at 62 youll get only 70 of your standard benefit if your FRA is 67 or 75 if your FRA is 66. Simply enter your day rate and the IR35 Calculator will show you a sample breakdown of available Umbrella options.

Working 52 weeks per year. Don worry as youll be assigned a Payroll Account Manager wholl will be on hand to help and ensure you recieve all. Select Self Employment to calculate your net income if you are a sole trader.

Our FICA tip calculator can help find potential savings by entering information about your employees their wages and average hours per week. Payroll services are provided by umbrella companies who employ agency contractors working on temporary contract assignments usually through recruitment agencies. Access Financial is the leading international payroll and contract management solutions provider to recruiters corporations and professional contractors.

Income field generated by rate x pay. Find out how much your salary is after tax in two clicks. With the April 2021 IR35 changes now long past you might find any new assignments you get falling inside IR35.

HR Services PEO 866. Every month you delay benefits increases your checks slightly until you reach. Payroll Time Attendance Benefits Insurance 833-729-8200.

Whether its about contractual arrangements tax queries or payments. 43-4170 Receptionists and Information Clerks. Work smarter with SmartWork.

HR Services PEO Sales 866-709-9401 Contact Sales. We are 100 compliant reliable honest transparent. Corporation tax may.

Maintaining an active approach to State Unemployment Insurance SUI tax rates can help ensure you are not only compliant but not spending more than you must. Payroll Time Attendance Benefits Insurance 833-729-8200 Contact Sales. Find more information on what umbrella companies are and what they mean for you.

6 to 30 characters long. The team has extensive experience of the umbrella industry. Use our Dutch tax calculator to find out how much income tax you pay in the Netherlands.

Wondering what the differences are between umbrella and PEO. Clarity Umbrella also look after our team as we know how important they are to making this business successful. ASCII characters only characters found on a standard US keyboard.

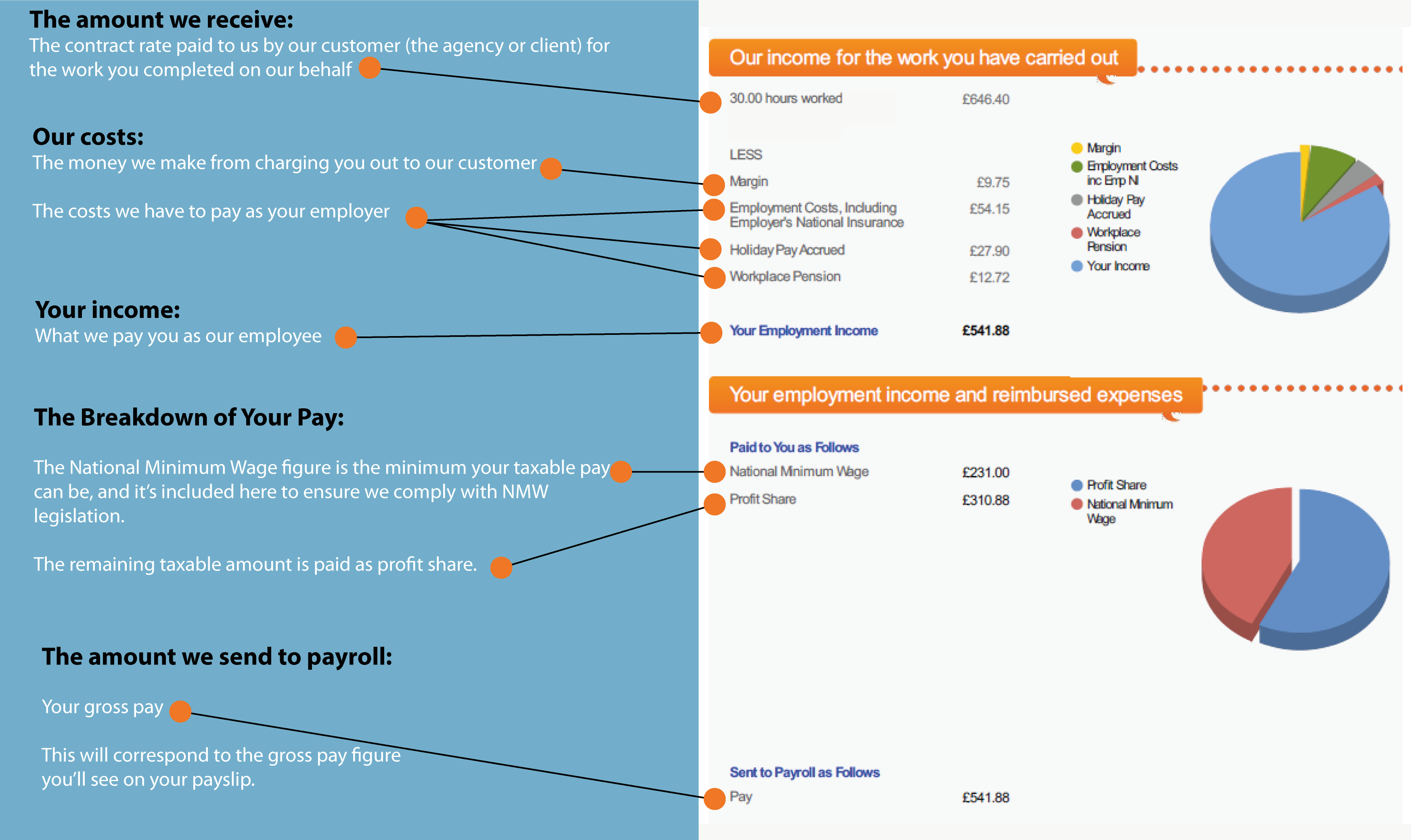

No Worries Umbrella is a UK registered entity and all our Umbrella company workers are paid using our UK based payroll. The Umbrellla Company will deduct fees expenses employers national insurance and then run payroll on your. The Umbrella will provide payroll for the contractor by acting as a go between with the Contractor agency on one end and the Client the actual.

Our umbrella payroll is used by contractors temps locums and freelancers. Must contain at least 4 different symbols. Assumptions for the PSC calculation.

The calculator will automatically be able to deduce the correct tax year or multiple tax years if the contract spans more than one. When do I get paid. It will then work out scenarios for.

Sole traders self employed receive additional tax credits lowering the total amount of tax paid. A margin of 15week. Income Tax Calculator 2022.

The off-payroll working rules are unlikely to apply if you are employed by an umbrella company. Our calculator will take care of calculating your entire contract value by taking the contract start and end dates using the contract rate you charge and applying it over workable days you set. With our calculator you can easily check how much you will get paid.

How Is Tax Calculated Explained Example Rates Simplified 2018 Calculator

Umbrella Salary Sacrifice Calculator

Umbrella Take Home Pay Calculator Paystream

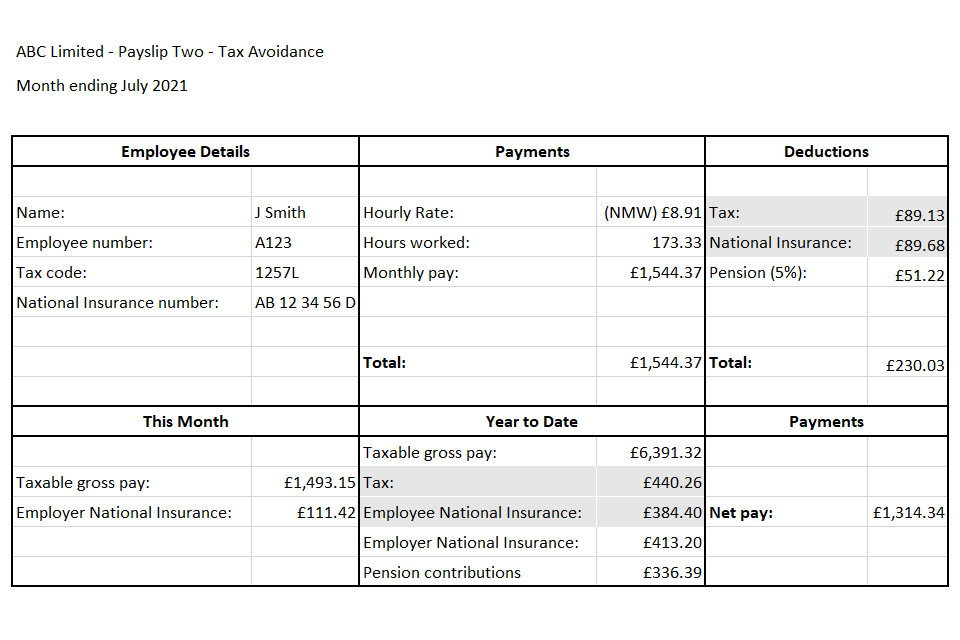

Check Your Payslip If You Work Through An Umbrella Company Gov Uk

Umbrella Company Payslips A Closer Look Orange Genie

Your Umbrella Payslip Explained Brookson Faq

Umbrella Take Home Pay Calculator Workwell Solutions

Umbrella Take Home Pay Calculator Workwell Solutions

Off Payroll Assignment Rates Pose Problems For Contractors Agencies And Clients

Take Home Pay Calculator Blog Boox

How Is Umbrella Pay Calculated Crest Plus

Online Construction Cost Calculator Construction Cost Umbrella Company Calculator

Umbrella Company Calculator Take Home Pay Calculator

Umbrella Take Home Pay Calculator Clarity Umbrella Ltd

Basw Launches Umbrella Company For Agency Social Workers

![]()

Umbrella Take Home Pay Calculator Clarity Umbrella Ltd

Umbrella Company Calculator Take Home Pay Calculator